tax forgiveness credit pa

PA CT NY and NC. Let Empower Federal Credit Union assist you with all your financial needs.

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

These are valuable lists.

. Line 22 Resident Credit Based on the instructions for PA-40 Line 22. Jimmy Panetta CA-20 Don Beyer VA-08 Mike Kelly PA-16 Cathy McMorris Rodgers WA-05. May I use the same payroll for PPP forgiveness the ERC FFCRA and WOTC.

People who meet the criteria can receive a refund of up to 05 on City Wage Taxes that their employer withheld from their. Free printable 2021 Pennsylvania Form PA-40 and 2021 Pennsylvania Form PA-40 Instructions booklet in PDF format to print fill in and mail your state income tax return due April 18 2022. Complete Lines 19 and 20 on Amended PA-40 21.

221380127 3154772200 800. No discounts are available for the Earnings Tax. The regulation at 61 Pa.

Income-based Earnings Tax refund. WOTC Work Opportunity Tax Credit is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. Line 17 Nonresident Tax Withheld from PA Schedules NRK-1 Nonresidents only 17.

SBA Paycheck Protection Forgiveness. An originally filed PA-40 Personal Income Tax Return for. To assist in streamlining the SBA forgiveness process Empower FCU is utilizing the SBA Paycheck Protection Program Direct Forgiveness Portal - Click.

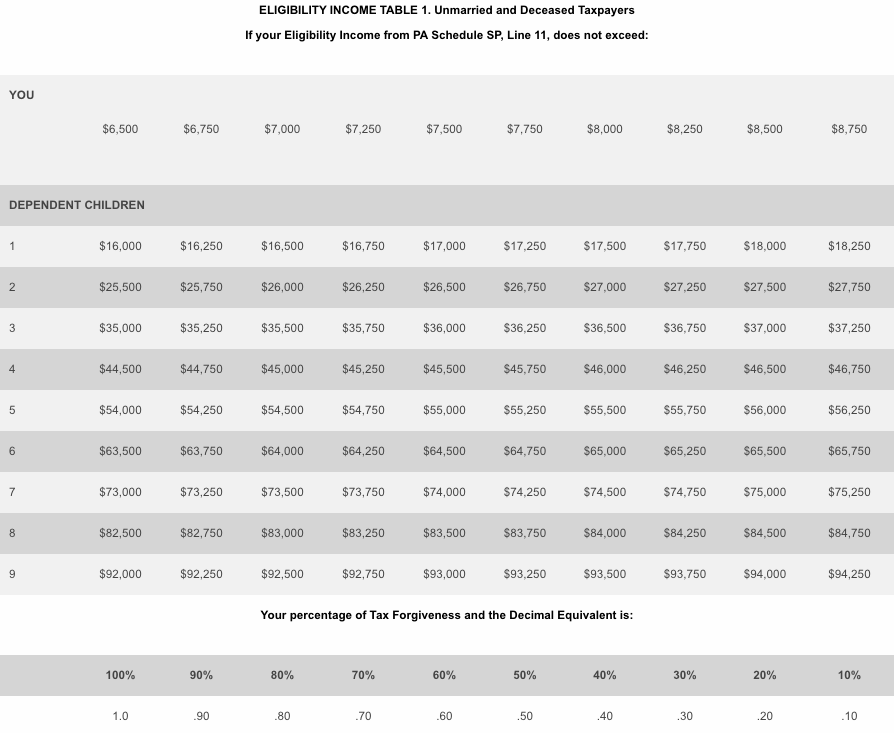

If youre approved for tax forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Earnings Tax refund. Code 3111 provides extensive lists of items that are presumed to become a permanent part of real estate construction activities on which a contractor owes tax versus items that are presumed to not become a permanent part of real estate sales activities on which a contractor charges tax. Any taxpayers claiming the Tax Forgiveness Credit on Line 21 of the PA-40.

Line 18 Total Withholdings and Payments. Pennsylvania state income tax Form PA-40 must be postmarked by April 18 2022 in order to avoid penalties and late fees. Add Lines 13 through 17 for Column A and C.

Line 21 Tax Forgiveness Credit. Or changes to any information in Sections I II or III of PA. An amended PA Schedule SP must be included with Sched-ule PA-40 X if increases or decreases in income amounts.

Are you eligible for a discount.

Pa Municipality Tax Return Out Of State Credit For School Tax

Pa Municipality Tax Return Out Of State Credit For School Tax

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Child Tax Credit Schedule 8812 H R Block

How Does The Ppp And Erc Affect The R D Tax Credit

What Families Need To Know About The Ctc In 2022 Clasp

Employee Retention Tax Credit Ertc Changes Professional Photographers Of America

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Irs Cp 79 We Denied One Or More Credits Claimed On Your Tax Return

What S The Most I Would Have To Repay The Irs Kff

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Employee Retention Credit Anfinson Thompson Co

Some Pennsylvanians May Be Missing Out On Pa Tax Refunds