ui federal tax refund

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. New Jersey State Tax Refund Status Information.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Include this total on the Total New York State tax withheld line on your New York State income tax return.

. Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. Total the New York State tax withheld amounts from all IT-1099-UI forms. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

For the most up-to-date information on filing a tax return with unemployment income. Americans who received unemployment compensation in 2020 may be eligible for a tax refund on any federal income tax paid on those benefits. In Box 4 you will see the amount of federal income tax that was withheld.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. On Form 1099-G.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The IRS has sent 87 million unemployment compensation refunds so far. Viewing your IRS account.

Learn more about this refund. File a premium federal tax return for free. Many filers are able to protect all or a portion of their income tax refunds by applying their.

FreeTaxUSA Federal 0. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

I filed as soon as I could at the end of January and I still havent gotten anything from the state the online tool to check says theyre still. Using the IRS Wheres My Refund tool. Unfortunately an expected income tax refund is property of the bankruptcy estate.

In Box 1 you will see the total amount of unemployment benefits you received. Blake Burman on unemployment fraud.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

How To Exempt Unemployment Compensation On Montana Form 2 Under Arpa Montana Department Of Revenue

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

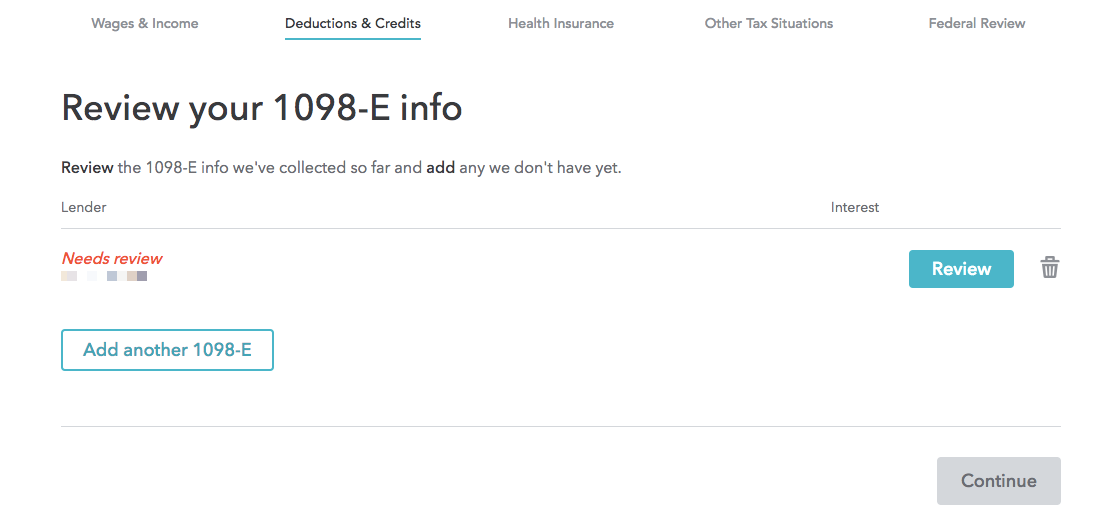

How Turbotax Turns A Dreadful User Experience Into A Delightful One Appcues Blog

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

1099 G Tax Form Why It S Important

Interesting Update On The Unemployment Refund R Irs

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Questions About The Unemployment Tax Refund R Irs

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

How To Get A Refund For Taxes On Unemployment Benefits Solid State

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Are Unemployment Benefit Payments Taxable At A State And Federal Level 1099 G Forms How Much Do I Have To Pay Based On My Withholding Aving To Invest